Finance Bill 2023 in Kenya: As the horizon of economic policies widens, the Finance Bill 2023 in Kenya emerges as a pivotal document, steering the financial course of Kenya. This post embarks on a journey to unravel the intricacies of the Finance Bill 2023, shedding light on its objectives, key provisions, and the potential ramifications for businesses and individuals across the nation.

Table of Contents

Historical Context of Finance Bill 2023 in Kenya

Before delving into the specifics of the Finance Bill 2023 in Kenya, a brief historical overview provides valuable context. The evolution of finance bills in Kenya unveils the legislative patterns that have molded the economic landscape over time, setting the stage for the present financial narrative.

Objectives Unveiled: Key Goals of the Finance Bill 2023

1. Revenue Generation and Fiscal Policy

One of the primary goals of the Finance Bill 2023 in Kenya is to bolster revenue for the government. Explore the proposed measures, including alterations in tax rates, new tax introductions, and adjustments to existing tax structures, all aimed at enhancing the fiscal capacity of the nation.

2. Economic Stimulus and Recovery Measures

In response to global economic challenges, the Finance Bill 2023 in Kenya is anticipated to encompass provisions for economic stimulus and recovery. Dive into the strategies employed by the government to stimulate growth, support businesses, and counter external economic pressures.

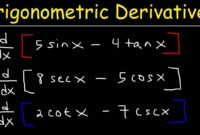

Unpacking the Core: Key Provisions of the Finance Bill 2023

1. Taxation Reforms

Income Tax: Expect changes in personal income tax rates, corporate tax rates, and the taxation of capital gains.

Value Added Tax (VAT): Explore modifications to VAT rates, exemptions, and the overall structure of the VAT system, unveiling the intricacies of consumption-based taxation.

2. Customs and Excise Duties

Delve into any proposed changes in customs and excise duties, dissecting their implications for importers, exporters, and local industries, and understanding their role in trade regulation.

3. Other Fiscal Measures

Beyond taxation, explore additional fiscal measures, including changes to government spending, public debt management, and financial regulations, all contributing to the economic framework of Kenya.

Impact Assessment: Implications for Businesses and Individuals

1. Business Sector

Scrutinize the potential implications of the Finance Bill 2023 on businesses, from changes in taxation to customs duties. Consider strategies for adaptation in the evolving financial landscape.

2. Individuals and Households

Analyze the direct consequences of the Finance Bill on individuals and households, assessing its impact on disposable income, spending patterns, and overall financial well-being.

Public Response and Stakeholder Engagement: A Two-Way Street

Examine the critical role of public participation and stakeholder engagement in shaping the Finance Bill. Understand how the government incorporates feedback from businesses, civil society organizations, and the general public in the final version of the bill.

Challenges and Criticisms: Unveiling the Debate

Explore the challenges and criticisms that accompany every finance bill. Consider alternative perspectives on the proposed fiscal measures and their potential implications.

The Dynamic Tapestry of Finance Bill 2023

In conclusion, the Finance Bill 2023 in Kenya is a dynamic and multifaceted instrument shaping the nation’s economic landscape. This post aims to provide a nuanced understanding, illuminating its potential impact on businesses, individuals, and the overall economic well-being of Kenya.