Risk Management: In the intricate world of finance, where uncertainty looms large and volatility is a constant companion, risk management emerges as a guiding beacon for individuals and institutions alike. It serves as the cornerstone upon which prudent financial decisions are built, offering a structured approach to identifying, assessing, and mitigating potential threats to financial objectives. From seasoned investors to fledgling enterprises, mastering the art and science of risk management is imperative for safeguarding wealth, optimizing returns, and ensuring long-term prosperity.

Table of Contents

Understanding Risk

At its essence, risk can be perceived as the probability of an adverse event occurring and its potential impact on financial outcomes. It encompasses a spectrum of uncertainties, ranging from market fluctuations and economic downturns to operational mishaps and geopolitical upheavals. Recognizing that risk is an inherent aspect of any financial endeavor is the first step towards effective risk management.

Types of Risk Management

Diving deeper, risk can be categorized into various types, each demanding distinct strategies for mitigation. Market risk, stemming from fluctuations in asset prices and macroeconomic trends, remains one of the most prevalent forms. Credit risk, on the other hand, pertains to the possibility of default by counterparties, borrowers, or issuers of financial instruments. Operational risk focuses on internal processes, systems, and human error, while liquidity risk revolves around the availability of funds to meet obligations. Additionally, there are risks associated with regulatory compliance, technological advancements, and even environmental factors, underscoring the multifaceted nature of risk management.

The Risk Management Process

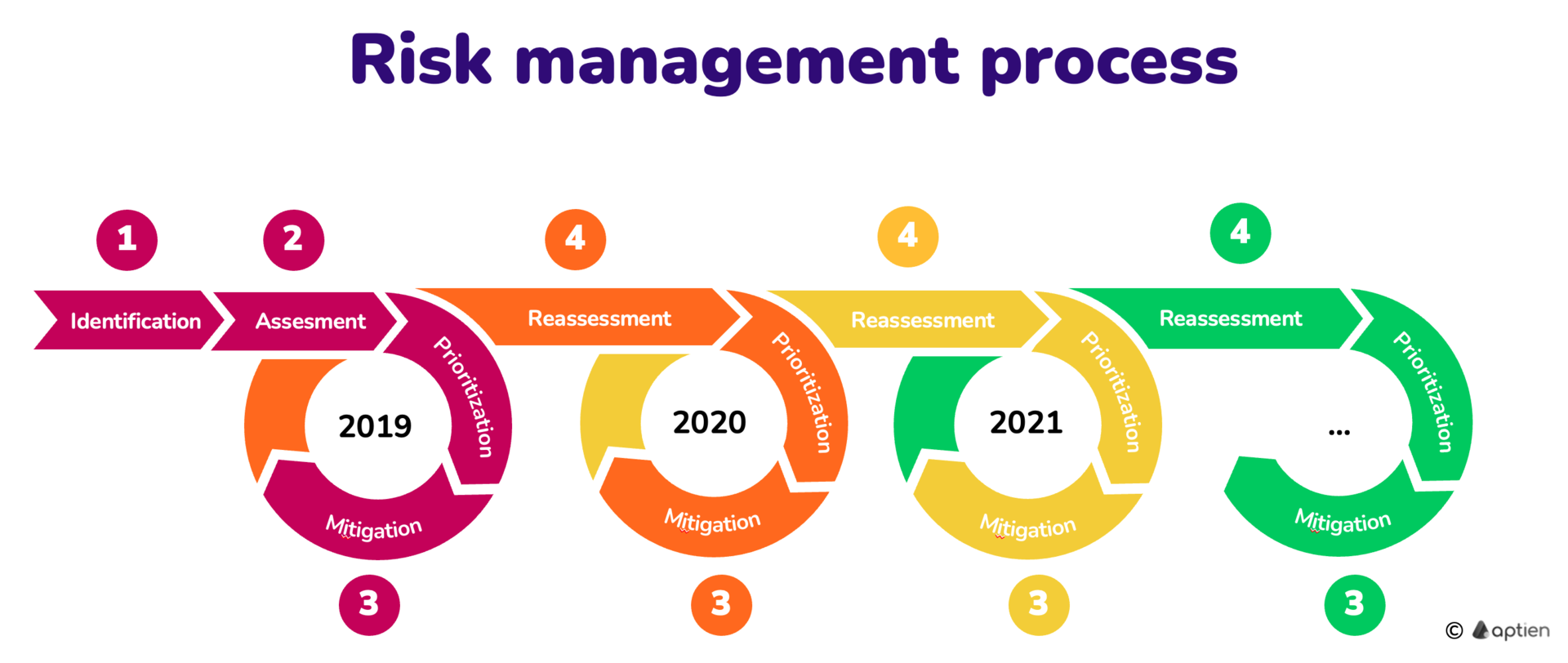

Risk Management: Effectively managing risk entails a systematic approach encompassing several interconnected stages. The process typically begins with risk identification, wherein potential threats are identified and categorized according to their nature and magnitude. This phase involves thorough analysis and scenario planning to anticipate adverse events before they materialize.

Subsequently, risk assessment comes into play, wherein the identified risks are quantified in terms of probability and potential impact. Various quantitative and qualitative techniques, such as sensitivity analysis and Monte Carlo simulations, are employed to gauge the severity of each risk and prioritize them based on their significance.

Once risks are identified and assessed, the next step involves risk mitigation, where strategies are devised to minimize the likelihood or impact of adverse events. This may involve diversification of investment portfolios, hedging through derivatives, implementing internal controls, or securing insurance coverage, depending on the nature of the risk and the risk appetite of the individual or institution.

However, it does not end with mitigation; it also encompasses ongoing monitoring and review. Markets and circumstances are dynamic, and risks evolve over time. Thus, regular monitoring of risk exposures, performance metrics, and external factors is essential to ensure the effectiveness of risk strategies. Moreover, periodic reviews and adjustments are necessary to adapt to changing market conditions and emerging risks, thereby maintaining resilience in the face of uncertainty.

Risk Management in Practice

In the real world, the application of risk management principles varies across different sectors and contexts. In the realm of investment management, for instance, portfolio diversification is a fundamental risk mitigation strategy aimed at spreading exposure across multiple asset classes to reduce the impact of adverse events in any single investment. Similarly, corporate management involves identifying and managing risks inherent in business operations, supply chains, and financial structures to safeguard profitability and ensure business continuity.

Financial institutions, including banks and insurance companies, employ sophisticated risk management frameworks to navigate regulatory requirements and maintain stability in the face of market turbulence. From stress testing and capital adequacy assessments to credit risk modeling and liquidity management, these institutions rely on robust risk management practices to uphold the trust and confidence of stakeholders while fulfilling their core functions.

Challenges and Opportunities

While risk management serves as a bulwark against uncertainty, it is not without its challenges. The complexity and interconnectedness of global financial markets, coupled with rapid technological advancements, have elevated the scale and velocity of risks faced by individuals and institutions alike. Moreover, the emergence of novel risks, such as cyber threats and climate change, presents new challenges that demand innovative solutions and adaptive strategies.

However, amidst these challenges lie opportunities for innovation and advancement. The proliferation of data analytics, artificial intelligence, and machine learning has empowered risk managers with powerful tools for risk identification, modeling, and decision-making. Advanced risk management systems and technologies enable real-time monitoring, scenario analysis, and predictive modeling, enhancing the agility and effectiveness of risk management practices.

Furthermore, the evolving regulatory landscape, spurred by lessons learned from past crises, has prompted greater emphasis on risk transparency, accountability, and resilience. Regulatory frameworks such as Basel III and Solvency II impose stringent requirements on financial institutions to bolster risk management capabilities and strengthen their ability to withstand shocks.

In conclusion, risk management is a fundamental discipline that permeates every facet of the financial world. It is a dynamic process that requires vigilance, adaptability, and strategic foresight to navigate the ever-changing landscape of uncertainty. By embracing a comprehensive approach to risk identification, assessment, mitigation, and monitoring, individuals and institutions can fortify themselves against potential threats while seizing opportunities for growth and innovation. In an era defined by volatility and disruption, mastering the art and science of risk management is not merely a choice but a necessity for sustainable success and resilience in the face of adversity.