What are Mutual Funds: In the vast and often intimidating realm of finance, mutual funds stand as a beacon of accessibility and opportunity for investors of all backgrounds. Whether you’re a seasoned player in the market or someone just dipping their toes into the world of investments, understanding what mutual funds are and how they work is fundamental to building a robust financial portfolio.

Table of Contents

Understanding What are Mutual Funds

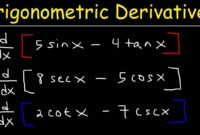

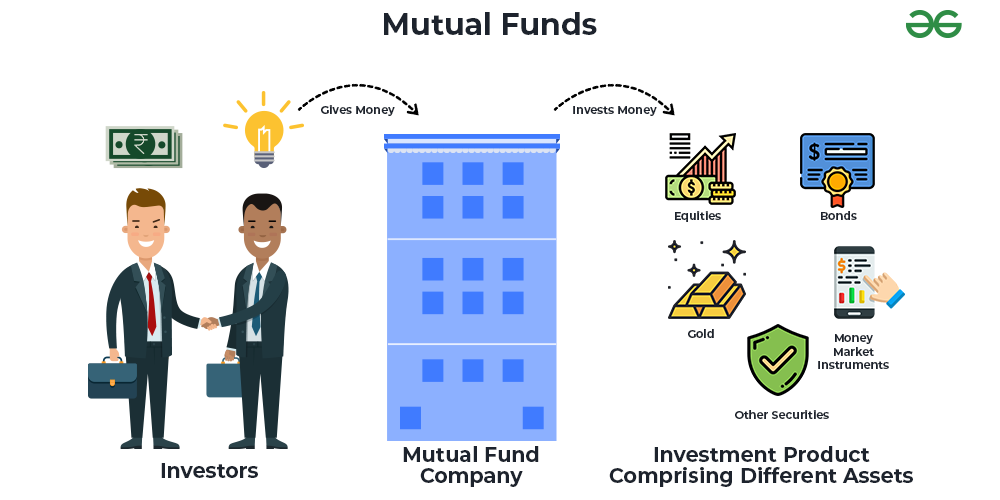

What are Mutual Funds: At its core, a mutual fund is a professionally managed investment vehicle that pools money from numerous investors to purchase a diversified portfolio of stocks, bonds, or other securities. This pooling of funds allows individual investors to access a diversified portfolio that would otherwise be difficult or costly to assemble independently.

How Mutual Funds Work

When you invest in a mutual fund, What are Mutual Funds, you’re essentially buying shares of the fund itself rather than owning the individual securities within it.

What are Mutual Funds: They come in various types, each with its own investment objectives and strategies. These can range from equity funds, which invest primarily in stocks, to bond funds, which focus on fixed-income securities like government or corporate bonds. There are also hybrid funds, money market funds, and sector-specific funds, among others.

Advantages of Mutual Funds

- Diversification: One of the most significant advantages of mutual funds is their ability to provide instant diversification. By investing in a mutual fund, you gain exposure to a wide range of securities, spreading out your investment risk.

- This expertise can be especially valuable for those who may not have the time or expertise to manage their investments actively.

- Affordability: Mutual funds typically have lower investment minimums compared to purchasing individual securities, making them accessible to a broader range of investors. Additionally, by pooling resources with other investors, you can benefit from economies of scale, potentially reducing transaction costs and fees.

- Transparency: Mutual funds are required to disclose their holdings, performance, and fees regularly, providing investors with transparency and accountability.

Risks Associated with Mutual Funds

What are Mutual Funds: They offer several advantages, it’s essential to understand the risks involved:

- Market Risk: Like all investments, mutual funds are subject to market fluctuations and the inherent risks associated with investing in securities.

- Manager Risk: The performance of a mutual fund can be influenced by the skills and decisions of the fund manager. Changes in management or investment strategy can impact fund performance.

- Fees and Expenses: Mutual funds charge fees and expenses for management, administration, and other services. It’s crucial to understand these costs and how they can affect your overall investment returns.

- Liquidity Risk: While mutual funds offer liquidity, there may be times when it’s challenging to sell shares, especially during periods of market volatility or if the fund holds illiquid assets.

Selecting the Right Mutual Fund

What are Mutual Funds: Choosing the right mutual fund requires careful consideration of your investment goals, risk tolerance, and time horizon. Here are some factors to consider:

- Investment Objective: Determine whether the fund’s investment objective aligns with your financial goals. For example, if you’re investing for retirement, a long-term growth fund may be suitable.

- Aggressive investors may opt for equity funds with higher growth potential, while conservative investors may prefer bond funds for stability.

- Performance Track Record: Evaluate the fund’s historical performance relative to its benchmark and peers. While past performance is not indicative of future results, it can provide insight into the fund’s consistency and management skill.

- Fees and Expenses: Compare the fees and expenses of different funds, including management fees, sales charges (loads), and other expenses. Lower fees can have a significant impact on long-term returns.

- Diversification: Consider the fund’s portfolio holdings and ensure it provides adequate diversification across asset classes, sectors, and geographic regions.

What are Mutual Funds: Mutual funds serve as a cornerstone of modern investing, offering individuals the opportunity to participate in the financial markets with ease and efficiency. By understanding what mutual funds are, how they work, and the various factors to consider when selecting them, investors can make informed decisions that align with their financial objectives and risk tolerance. Whether you’re saving for retirement, building wealth, or pursuing other financial goals, mutual funds can play a valuable role in your investment strategy, providing diversification, professional management, and potential for long-term growth.